- Link & Load

- Posts

- 🚀 Nvidia's AI Chip Surge | 🇺🇸 US Targets Chinese Chip Imports | 🪙 UK Cracks Down on Crypto Collapse

🚀 Nvidia's AI Chip Surge | 🇺🇸 US Targets Chinese Chip Imports | 🪙 UK Cracks Down on Crypto Collapse

Nvidia smashes earnings with AI chip demand fueling market optimism, while US lawmakers tighten the semiconductor supply chain by blocking Chinese gear imports. Meanwhile, the UK’s Serious Fraud Office launches a high-profile investigation into a $28 million crypto scheme

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

🖋 Today’s Angle

Nvidia crushes expectations again, fueling the AI frenzy with record chip sales and optimistic forecasts.

US lawmakers push to block Chinese chipmaking gear imports tied to CHIPS Act benefits—semiconductor sovereignty gets serious.

AI boom brings fresh market jitters with soaring deal activity and debt, amid fears of overheating.

Bitcoin’s recent rally fizzles, slipping back to $88K after Nvidia-driven spike.

UK’s Serious Fraud Office dives into a $28M crypto collapse, a cautionary tale for investors.

––Sascha Thiele

🚀 Tech & Business

What Happened: Nvidia posted jaw-dropping Q3 results, with $57 billion in revenue (+62% YoY) and a 65% profit jump, beating analyst forecasts by a mile. CEO Jensen Huang said Blackwell GPUs are flying off the shelves with cloud GPUs sold out, signaling unabated AI infrastructure demand. Nvidia’s outlook is bullish, projecting $65 billion in Q4 sales.

Why It Matters: Nvidia is the AI boom’s beating heart, and its performance shapes the tech market pulse like few others. Its chip dominance propels not only itself but scores of cloud and AI companies, underpinning the current tech rally—and marking AI’s blade-edge of growth and innovation. Investors and 401(k) holders alike are watching closely.

What Happened: A US legislative push aims to bar recipients of CHIPS Act funds from using Chinese chipmaking equipment for at least a decade. The move targets Beijing’s tech ambitions by limiting access to advanced semiconductor gear from China, tightening the supply chain chokehold amid broader tech tensions.

Why It Matters: This hardening stance highlights the semiconductor industry’s geopolitical importance. The US is trying to keep AI and chip infrastructure innovations domestically controlled, which might reshape global trade flows and tech cooperation—potentially intensifying the chip war and supply chain bifurcation..

What Happened: The AI gold rush isn’t just boosting chipmakers—it’s stirring volatility in US markets. M&A activity has surged, fueled by tech companies' hunger for AI mastery, while corporate debt is swelling, and market jitters persist about an AI bubble. Analysts warn these dynamics signal heightened risks for investors.

Why It Matters: The AI boom is double-edged, as it powers innovation while introducing new market instability. How this balances out will shape tech valuations and investment flows in the near future. And on the plus side: AI might just make M&A lawyers the busiest people in town..

👾 My Software Stack

The concept of Manychat is easy: get rid of manual work on Instagram and use automations to make money. Use the link to get one month of the pro subscription for free.

*This is an affiliate link, so I would get a small commission if you use the tool.

💰 The Finance Overview

Giphy

The tech sector is on a fascinating rollercoaster today, anchored by Nvidia’s stellar results that sent chip stocks higher after a tumultuous start to November.

Nvidia's massive AI chip sales confirm the tech industry's dependence on AI infrastructure, boosting sentiment for cloud and semiconductor stocks. Meanwhile, US lawmakers are tightening regulations on Chinese chip equipment, emphasizing the rising geopolitical risk in tech supply chains.

The AI boom continues to propel dealmaking, but mounting debt levels and concerns about market overheating linger.

Keep an eye on chipmakers and cloud providers—they're the real barometers of this AI-driven market wave. One day, these chips will be smart enough to tell us their market forecasts themselves.

Ticker |

|---|

S&P 500: $SPY ( ▲ 0.45% ) |

DowJones: $DJI ( ▲ 0.4% ) |

Nasdaq: $QQQ ( ▲ 0.77% ) |

German DAX: $DAX ( ▲ 0.06% ) |

Indian NIFTY: $NIFTY50.NSE ( ▼ 0.75% ) |

Bitcoin: $BTC.X ( ▲ 0.72% ) |

Ethereum: $ETH.X ( ▲ 0.74% ) |

🎰 Crypto Carousel

Gif by darkbean on Giphy

What Happened: Bitcoin surged above $93K following Nvidia’s AI chip triumph, sparking hopes for a fresh crypto bull run, but quickly gave up gains, settling back near $88K. Ethereum and crypto stocks also retreated, underscoring the volatility tied to tech sector swings.

Why It Matters: Crypto’s fate remains tied to broader tech cycles and investor sentiment around AI’s promise. This quick tumble highlights crypto’s risk profile in a market spooked by uncertainties after tech rallies—proof that even coins need a good night’s sleep

What Happened: The UK’s Serious Fraud Office is investigating the collapse of Basis Markets, a $28 million crypto scheme. Arrests have been made, and investors are urged to come forward. The case highlights rising regulatory scrutiny in crypto and the risks investors face.

Why It Matters: This investigation shines a light on ongoing crypto market challenges—fraud risks, regulatory crackdowns, and the need for vigilance by investors. It underscores crypto’s Wild West reputation, reminding you that not all that glitters in blockchain is gold.

Startups get Intercom 90% off and Fin AI agent free for 1 year

Join Intercom’s Startup Program to receive a 90% discount, plus Fin free for 1 year.

Get a direct line to your customers with the only complete AI-first customer service solution.

It’s like having a full-time human support agent free for an entire year.

🎓 Skill Builder

Freecodecamp.org - Published November 16, 2025

What You'll Learn:

Efficient data manipulation with Pandas

Numerical computing basics with NumPy

Cleaning noisy data sets like a pro

Data visualization techniques

Leveraging these tools for real-world analytics projects

Why It's Worth Your Time: If you want your data to tell stories, not just sit there, this is the kickstart you need—straight from the pros with hands-on examples.

🎲 Link Grab-Bag

✅ guideflow.com — The AI demo automation platform for SaaS

✅ todoist.com — The to-do list to organize work & life

✅ dimension.dev — AI that connects with your tools and automates the busywork

✅ gemini3audit.com— Find out what Gemini 3 knows about your brand

✅ getspine.ai — Go beyond chat — collaborate visually with 300+ AI models

Got a killer link we missed? Hit reply and share the goods. 💌

🏁 Tomorrow’s Forecast

AI chips keep sizzling, but watch out—the next market twist is one power surge away ⚡️

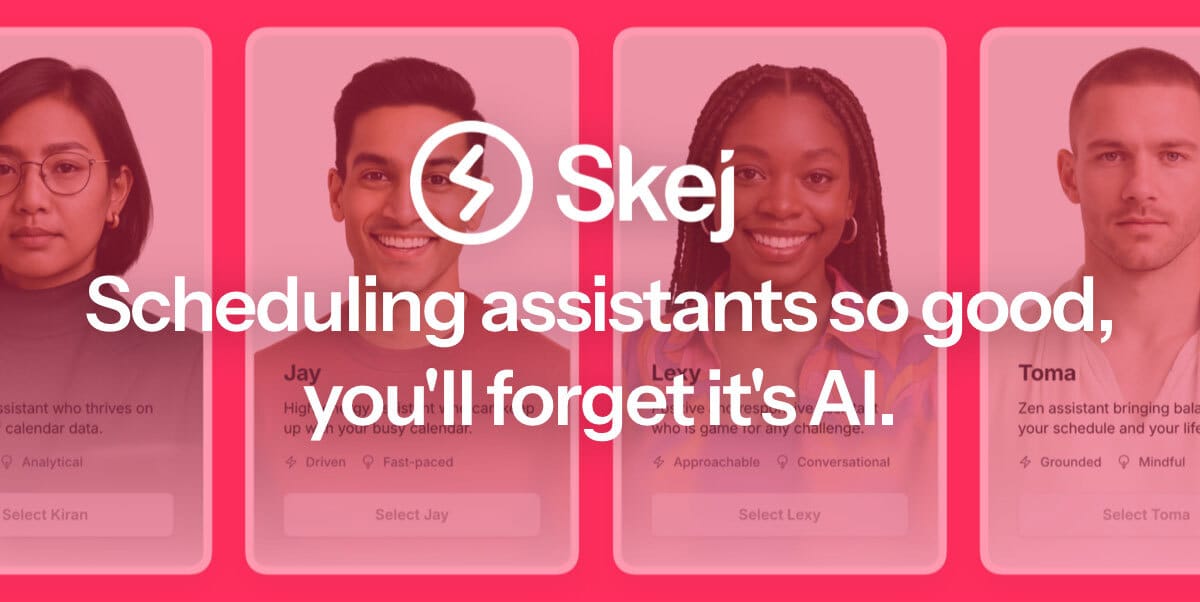

An AI scheduling assistant that lives up to the hype.

Skej is an AI scheduling assistant that works just like a human. You can CC Skej on any email, and watch it book all your meetings. Skej handles scheduling, rescheduling, and event reminders. Imagine life with a 24/7 assistant who responds so naturally, you’ll forget it’s AI.

Start your own newsletter and get a 30-day trial + 20% off for 3 months. Sign up here.

Reply